Just over ten years ago, Devanahalli was a name most investors in Bengaluru’s real estate space overlooked. Tucked around 40 kilometers north of the city center, this village was more associated with serene countryside and ancient temples than promising real estate returns. But for those who paid attention to the early ripples of change, Devanahalli was quietly preparing to become one of India’s most compelling investment stories.

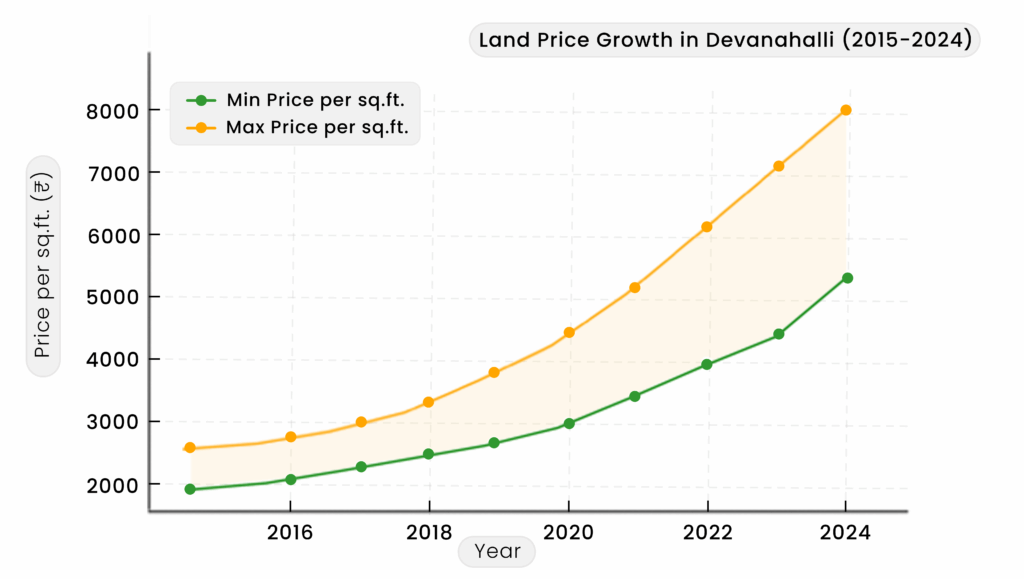

In 2015, land in Devanahalli was priced modestly at around ₹2,000 to ₹2,500 per sq.ft. That same land, in 2024, is now trading anywhere between ₹5,500 and ₹8,000 per sq.ft., depending on its proximity to infrastructure and industrial corridors. That’s a 2x to 3.5x return within ten years, with several micro-markets in the region witnessing appreciation as high as 150–175% in just the last five years. These aren’t vague estimates—they’re backed by actual transaction data and market absorption rates.

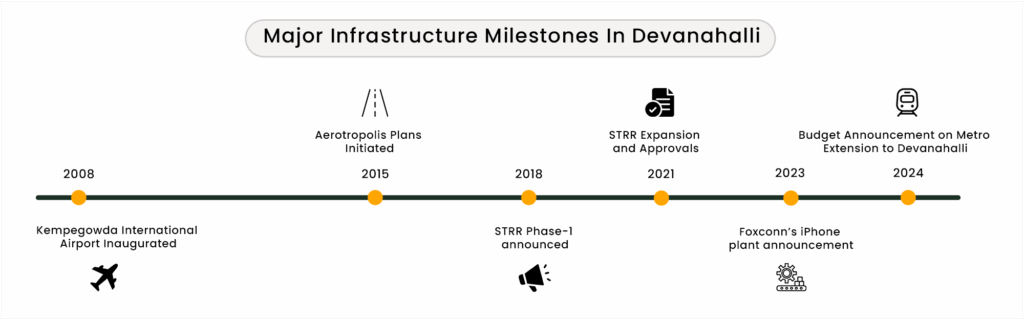

The spark that set this momentum in motion was the opening of the Kempegowda International Airport in 2008. While its immediate impact on the land market wasn’t explosive, the potential it unlocked was undeniable. For the first time, Bengaluru had a globally connected aviation gateway located well outside the city’s traditional boundaries. It didn’t take long for serious investors to realise that the gravitational pull of the city was moving north.

By 2015, the aftershocks of that single infrastructure move became visible. Devanahalli, once dismissed as distant, was now seeing interest from large developers and institutional players. Government planners started mapping out logistics corridors and new connectivity projects. Plans for an Aerotropolis began taking shape. SEZs were proposed. Corporate interest followed. Land that once lay idle began to see purpose. And for those who were watching closely, it was clear that Devanahalli was quietly stepping into Bengaluru’s future.

The year 2023 became a defining moment. Foxconn, the Taiwanese electronics giant and Apple’s key manufacturing partner, announced a 300-acre iPhone production facility near Devanahalli. The market reaction was swift. Within weeks, local property prices reportedly surged by 30–35%. Plots that were trading around ₹4,500 per sq.ft. jumped beyond ₹6,000. For investors who had entered just a year or two earlier, the returns came faster than anyone had anticipated. It was proof that industry—not just speculation—was now shaping the land value curve.

And it wasn’t just private investment that was changing the landscape. The Karnataka government’s 2025 budget brought yet another boost: an extension of the Namma Metro line from Bengaluru to Devanahalli. This means that in the near future, a seamless metro ride could connect residents and workers from the city to the airport region. Add to that the Satellite Town Ring Road (STRR)—a 280+ km mega-road infrastructure project aimed at linking Bengaluru’s outer zones—and suddenly, Devanahalli is no longer on the periphery. It’s at the crossroads of connectivity, commerce, and community.

The domino effect has been impressive. Developers responded with plotted developments, premium villa communities, and high-rise residential projects tailored for airport employees, IT professionals, and the emerging business ecosystem. There’s now a consistent demand-supply narrative being written, with many projects being marketed not only as homes but also as strategic land investments.

Looking back, what Devanahalli offers isn’t just a record of price appreciation—it’s a blueprint. The transformation was never about a single headline or a one-time announcement. It was about recognizing a pattern. The airport was the trigger. The government-backed infrastructure came next. Industry followed. Then came residential and commercial development. It’s a cycle of growth that played out in plain sight, but only for those who knew how to read it.

The real story here is not just about the value that Devanahalli has already created. It’s about what this place teaches investors—especially those exploring alternative assets like land—about spotting early-stage opportunities. These pre-boom micro-markets don’t shout. They whisper. They show up in small government notifications, quiet land aggregations, or industrial MoUs. They’re places where road widening begins quietly or metro routes are redrawn. And if you wait for the press releases and news stories, chances are you’ve already missed the steepest part of the curve.

Devanahalli was that whisper a decade ago. Today, it’s a success story. But in the world of land investment, timing is everything. And while the latecomers can still benefit, the outsized gains are almost always reserved for the early believers.

So, the key question is not how much Devanahalli has grown—but whether you’re ready to identify the next Devanahalli. Because while the names and locations will change, the pattern never does. You don’t just invest in land. You invest in vision, in future potential, in the direction of economic movement.

Up Next in Our Case Study Series: We head north to the NCR region to explore how land values around the upcoming Noida International Airport are beginning to mirror Devanahalli’s early days. Stay tuned.